Bristol’s Consulting staff is increasingly called upon to support and provide direction to our clients’ policy review efforts. In our February 2019 Consulting Corner, we provided a detailed framework for International policy review, focusing on the continuing trend toward “segmentation” and aligning multiple policies to specific business needs. That discussion may be found here: https://www.bristolglobal.com/bristol-news/global-mobility-policy-2019-is-your-international-policy-aligned-to-address-your-business-needs/

In our view, companies are currently applying a similar approach in reviewing their U.S. and Canada domestic relocation policies, tiering them primarily by job level, and homeowner / renter.

At our recent Bristol Connect meeting in Coronado, California, Bristol conducted a workshop addressing these trends for both International and domestic policies. Here we will summarize the domestic outline that was discussed.

Domestic Policy Review: Suggested Approach

Benchmarking is an important first step to measure your policies against current competitive practices. However, it is not an end in itself. It important to understand the limitations of benchmarking. By definition, it represents other companies’ practices and is in a way backward-looking, not forward-thinking. Companies should review their own specific business drivers: their major origin and destination locations, their unique employee demographics, homeowner vs. renter population, potential differences between new hires and current employees, etc., and then select broad policy tiers along with defined benefits that:

- Align mobility to the company’s overall business and talent management strategies;

- Meet business units’ desire for maximum flexibility and customization;

- Respond to the varying needs of Talent Acquisition / Recruiting;

- Meet leadership’s demand for cost containment and reduction;

- Overcome potential barriers to relocation including family reluctance and assignments to difficult locations;

- Focus on a high quality employee experience; recognizing that a satisfied well-supported transferee is a more productive one!

Policy Design Considerations

Figure 1 presents a popular three-tier framework for a domestic relocation policy, along with brief commentary on a few selected policy benefits:

Figure 1: U.S. RELOCATION: BEST PRACTICES SUMMARY

Policy Design Notes

Home Sale: Bristol recommends companies carefully decide their position on the home sale benefit, for which transferees (if any) it would apply, along with any budgetary restrictions.

Bristol strongly recommends that companies consider a formal home sale policy with a managed Buyer Value Option (BVO) program at the center to incentivize the home owning transferee to accept a relocation.

The BVO process remains central to U.S. relocation, utilized by well over 60% of companies. BVO is truly one of the foundational pillars of our industry, protected by the Unites States tax code specifically to encourage workforce mobility. It is in fact now the only major remaining tax-protected relocation benefit, untouched by the 2018 tax act which repealed tax exclusions for other relocation benefits. That said, BVO is still a high-cost benefit and thus may not be appropriate for all companies, all homeowners or all levels of employee.

For Canadian transferees the common approach is Direct Reimbursement of most closing costs including realtor commissions, transfer tax, appraisals and other fees. Unlike for the U.S. such reimbursements are intrinsically not taxable when connected to relocation, therefore a BVO process does not exist.

Additional policy provisions: Next, review each additional key policy provision including household goods shipment, temporary living, final move travel, spousal support, miscellaneous expenses etc. again considering the necessity of each component and any budgetary concerns (more on cost targets below).

Managed Services or Lump Sum? Companies traditionally provide directly managed services for each policy provision according to the reasonable and actual need of each transferee. Many feel this results in the most satisfactory employee experience with the highest level of personal and family support. However, managed services are increasingly being replaced by a variety of partial lump sum approaches designed to provide a greater degree of flexibility and cost control. Bristol addressed this trend in great detail in a recent Consulting Corner that may be found here: https://www.bristolglobal.com/bristol-news/does-your-lump-sum-policy-need-a-check-up/

Cost Targets

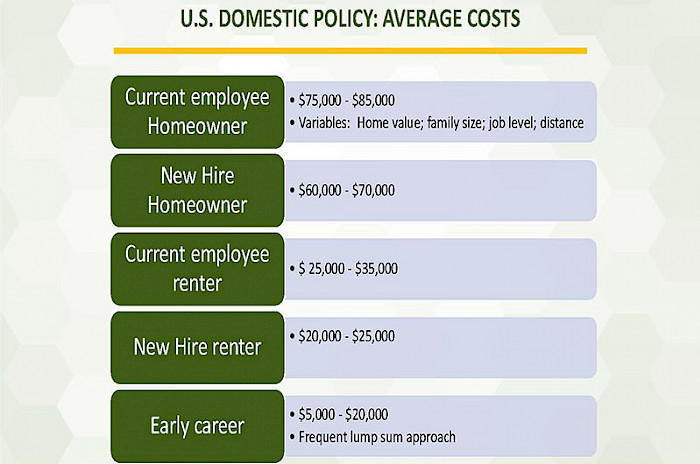

In order to provide a helpful context for budgeting your relocation programs, consider the following average costs (net of tax gross-up) as estimated by Worldwide ERC (2017) combined with Bristol’s own client base:

Figure 2: U.S. RELOCATION – AVERAGE COSTS SUMMARY

Talk to Bristol!

Bristol’s Consulting department assists our clients in evaluating, benchmarking and improving their mobility policies to meet the specific requirements of their unique businesses. For advice on how to apply the concepts discussed in this article, or for any related questions, please contact your Bristol account director or reach us at info@bristolglobal.com to discuss how we may assist you!